| Vorheriges Thema anzeigen :: Nächstes Thema anzeigen |

| Autor |

Nachricht |

FrankJScott

Gast

|

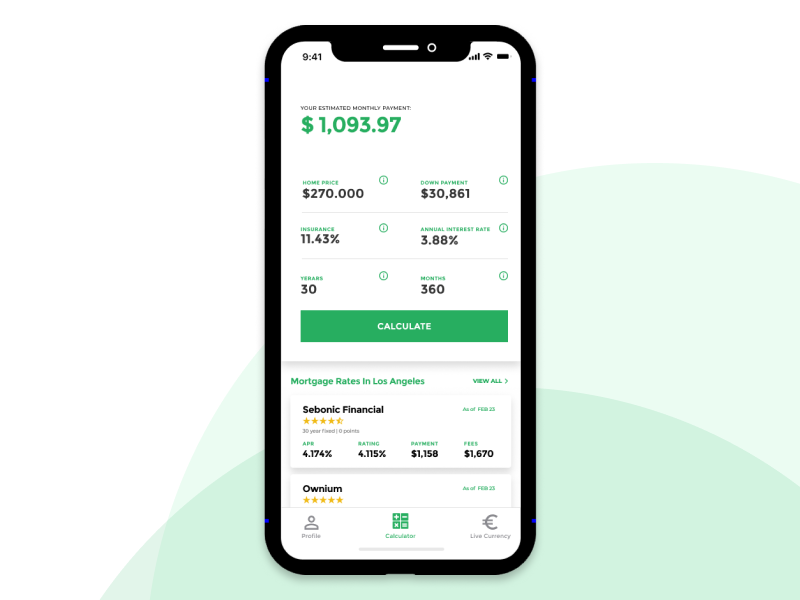

Verfasst am: 03.01.2023 - 11:14 Titel: Affordable Mortgage Calculator Blog Verfasst am: 03.01.2023 - 11:14 Titel: Affordable Mortgage Calculator Blog |

|

|

Your Ultimate Guide Cash-Out Refinance In Real Estate

The acquisition of a house is one of the largest investment you can make. It's essential to make sure that the home is well-maintained and comfortable. It's difficult to build up the savings needed for home renovations, repairs and upkeep. There is a possibility that you can avail refinancing of cash-outs. This cash can be used to finance your home improvements, instead of using credit cards, a personal or second mortgage loan. A cash-out refinance is an option to pay off student loans, consolidate debt, or to cover the cost of repairs. We'll go over the specifics of refinancing cash-outs so your decision is simple.

What Is A Cash-Out Refinance?

Cash-out refinances let you convert your home equity to cash. The new mortgage is for more than the current mortgage balance. The difference is paid in cash. Refinancing generally means replacing an existing mortgage with a new one with more favorable terms for the borrower. Refinancing mortgages may help cut down on monthly payments , and even get a lower interest rate. It also allows you to re-evaluate the periodic loan terms. See the most popular home loan calculator for site tips.

How Cash-Out Refinances Work

Cash-out refinances let you make your home a collateral to secure a loan. You will also get some cash. This creates a larger mortgage than the current one. Home equity can be used to fund for emergency expenses, wants or needs. Cash-out refinance applicants can find lenders who are willing to collaborate with them. Lenders examine the borrower's credit as well as current mortgage conditions. They also look at the amount needed to repay the loan. The lender makes an offer based upon the underwriting evaluation. The lender makes an offer. A cash payment along with the mortgage payment is required. The borrower isn't able to get cash as part of a typical refinance. They only get lower monthly payment. The cash-out refinance money can be utilized in any manner the borrower likes. Many borrow the money to pay off large loans or to pay medical expenses or even for emergency funds. A cash-out refinance will result in a home with lower equity, which means the lender takes on greater risk. The closing costs, the fees and rates of interest in a cash-out refinance may be more expensive than an ordinary one. Borrowers with specialty mortgages such as U.S. Department of Veterans Affairs loans (VA) can often refinance with lower rates and better terms than loans for non-VA loans. Follow the recommended loans for site recommendations.

Exemple Of Cash-Out Refinance

Consider buying a property valued at $300,000 using a mortgage of $200,000 and owing $100,000 after many years. If the property's worth is not lower than $300,000. You also possess at least $200,000 equity. If the rates are low or you are refinancing the underwriting process could allow you to borrow as much as 80 percent of your equity. Even though many people will not be ready to take on a loan of $200,000, equity may increase your cash flow. Think about the fact that 75% of the property's value is accessible to the lender. If you own an $300,000.00 home this would translate to $225,000. The remaining principal amount must be paid back with $100,000 leaving you with $125,000 in cash. If you require $50,000, you can refinance the $150,000 mortgage to a lower interest rate and better terms. In the loan you take out, you'll receive the $100,000 remaining balance and $50,000 in cash. You could take on a $150,000 loan, receive $50,000 in cash and start making monthly payments on the whole amount. This is among the advantages of collateralized mortgages. The disadvantage is that the $50,000 and $100,000 combined loans can be used to finance your home. |

|

| Nach oben |

|

|

|

|

Du kannst keine Beiträge in dieses Forum schreiben.

Du kannst auf Beiträge in diesem Forum nicht antworten.

Du kannst deine Beiträge in diesem Forum nicht bearbeiten.

Du kannst deine Beiträge in diesem Forum nicht löschen.

Du kannst an Umfragen in diesem Forum nicht mitmachen.

|

Powered by phpBB © 2001, 2002 phpBB Group

Deutsche Übersetzung von phpBB.de |

|

|